Archives: Posts

Three Simple Ways to Get More from Your CPA, Payroll, and IT Teams

Running a business means juggling dozens of moving parts, from payroll and taxes to technology and client relationships. For many small and mid-sized businesses, partnering with outside professionals for accounting, payroll, and IT support helps keep operations efficient and compliant.

At Canon Capital, we work with business owners across the Delaware Valley who are doing it all, and we’ve noticed a few small actions that make a big difference in how smoothly things run. Here are three simple ways to get even more value from your CPA, Payroll, and Technologies teams.

Payroll: Keep Us in the Loop When People (and Pay) Change

Hiring a new team member? Someone leaving the company? Giving a raise or changing a pay structure? Letting your payroll provider know right away ensures accurate paychecks and compliance with both federal and local tax requirements.

Each municipality in Pennsylvania can have different local earned income tax rates, and reporting changes promptly helps avoid under- or over-withholding. It also makes sure that your quarterly filings and year-end W-2s are accurate, saving time and future frustration.

A quick email or message when staffing changes occur allows your payroll specialists to:

- Update employee tax profiles and direct deposit info

- Verify start or end dates for pay periods

- Adjust benefit and deduction settings

It’s a small step that can prevent big headaches and help keep your team happy and paid correctly.

CPA: Call Before You Make a Big Financial Move

One of the best ways to maximize your CPA relationship is to make it proactive, not reactive. We love to hear from clients before they make a major financial decision, like purchasing new equipment, changing business structures, or expanding to a new location.

Why? Because those moves often carry tax implications that can be managed strategically with advance planning. When you loop in your CPA early, we can help you:

- Determine the most tax-efficient timing for purchases or deductions

- Evaluate whether a lease or buy makes better sense

- Review cash flow and financing impacts

- Ensure your business structure still aligns with your growth plans

A short phone call today can mean smoother filings and potentially thousands in tax savings tomorrow. Think of your CPA as part of your strategic team, not just the person who prepares your returns.

Technologies: Send a Better Ticket for Faster Fixes

We know IT issues can slow everything down. The fastest way to get back up and running is to give your tech team the right details up front.

When submitting a support ticket, include:

- What happened and when. (“Outlook froze at 9:15 a.m. after sending an email with an attachment.”)

- Any error messages or screenshots. These help pinpoint the issue immediately.

- Steps you’ve already tried. Did you restart your computer? Disconnect from Wi-Fi? Mention it.

This level of detail helps the Technologies team quickly recreate the issue, find the root cause, and deliver a faster solution. The result? Less downtime, fewer back-and-forth emails, and more time focused on your work.

Bringing It All Together

At Canon Capital, our CPA, Payroll, and Technologies teams work toward making sure your business runs efficiently from every angle. A little proactive communication helps us help you faster.

If you’re ready to partner with a team that values efficiency, accuracy, and your long-term success, we’d love to talk.

Contact us today to see how Canon Capital can make your business operations simpler and stronger.

The “One Big Beautiful Bill”: What Business Owners Need to Know

The “One Big Beautiful Bill Act” (OBBBA), signed into law on July 4, 2025, reshapes a lot of tax rules that touch everyday business decisions, from buying equipment to offering benefits. Here’s a recap of our recent webinar, with a focus on what matters for your company and for you as a business owner.

The big wins for businesses

100% bonus depreciation is back (and “permanent”)

For property placed in service after Jan. 19, 2025, you can fully expense eligible purchases in year one. A one-year transition election helps if you planned for lower rates. Pair with cost segregation to accelerate write-offs.

Section 179 gets larger

For tax years beginning after December 31, 2024, expensing limits jump to $2.5M (phase-out begins at $4M), indexed for inflation.

New 100% write-off for certain real property

Qualified U.S. production facilities started after January 19, 2025 and finished before January 1, 2031 may qualify, which is an incentive to onshore manufacturing.

1099 relief

- 1099-K returns to a higher bar starting in 2025. Reporting kicks in only if both $20,000+ and 200+ transactions.

- Standard 1099-NEC/MISC threshold rises from $600 to $2,000 in 2026 (inflation-indexed from 2027).

Employee benefits you can use to recruit/retain

- Dependent care FSA exclusion increases to $7,500 (after 2025).

- Employer student-loan payments under education assistance plans are permanent and tax-free to employees.

- Meals & entertainment tweaks in 2026: Entertainment is still non-deductible while “employer convenience” meals lose the 50% deduction. Client meals stay 50% and company parties remain 100%.

- R&D expensing (domestic) has been reinstated, with a retroactive option for 2022–2024 for certain small businesses.

- Opportunity Zones made permanent.

- ERC enforcement tightens (6-year statute; no payments for claims filed after Jan. 31, 2024).

Benefits for you as an individual

- Tax brackets & higher standard deductions from the Tax Cuts and Jobs Act are made permanent (with slight tweaks at the low end).

- SALT cap relief. Temporarily increases to $40,000 for 2025 (phased out at higher incomes), edges up slightly through 2028, then reverts to $10,000 in 2029.

- QBI (199A) is permanent. Expect wider phase-outs and, starting 2026, a $400 minimum deduction if you have at least $1,000 of QBI.

- 529 plans expand (more K-12 and skills/credential uses starting after 2025).

- New kids’ investment accounts (2025–2028 births): contribute up to $5,000/year after-tax, federal adds $1,000, favorable tax on qualified uses (college, first home, starting a business).

- Estate & gift exclusion effectively set at $15M in 2026 (inflation-indexed).

In addition, temporary deductions available from 2025 to 2028 include:

- Senior deduction: $6,000 per person ($12,000 Married Filing Joint Returns) age 65+.

- Tip income: Deduction up to $25,000 (MAGI phase-outs apply).

- Overtime: Deduction up to $12,500 per taxpayer (phase-outs apply).

- Car-loan interest: Deduct up to $10,000 on new, U.S.-assembled personal vehicles (interest incurred after 12/31/24, phase-outs apply). Excludes Fleet Sales, Used Cars, Cash Out Loans on Previous Purchased Vehicles, Lease Financing, and Related Party Loans

Next Steps

This law is complex, with phase-outs, overlapping dates, and many moving parts. We recommend viewing the recording of the webinar and consulting the accompanying slide deck..

The IRS is also working through staffing and budget constraints, so filing season guidance could be late. Treat 2025–2026 as a planning window, not a “set it and forget it.”

As always, we are here to help. If you have any questions about how this legislation applies to your situation, call us at 215-723-4881.

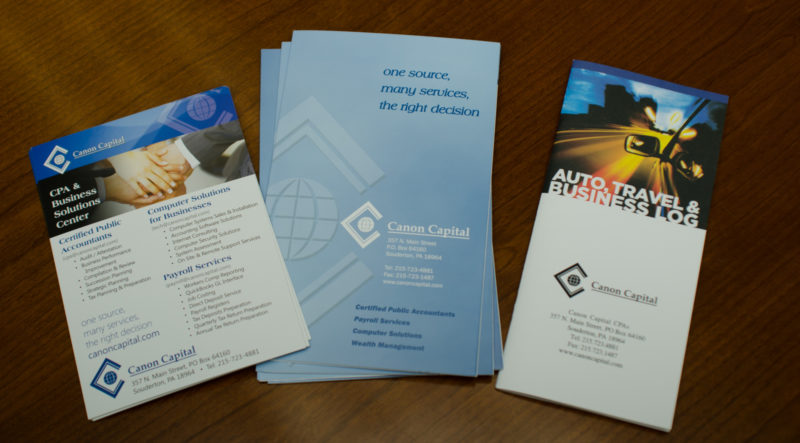

One source, many services, the right decision.

If you have questions about next steps or if we can be of service, please contact us online or call 215-723-4881.

(Please note: This presentation is for general introduction only and should not be relied upon for planning purposes, as regulations and interpretations are still being developed. Dollar amounts generally apply to Married Filing Joint returns, with other filing statuses likely having different amounts.)

Elm Terrace Gardens Technical Support Request

The web based support form is no longer in use. Please use the green IT button on your Windows desktop or system tray to submit a support request. If you do not have the green IT button, please give us a call at 215-723-4881, extension 800, and we will be happy to assist you.

Computer Recycling Program

In an effort to support our environment, provide our customers with a cost-effective, easy way to dispose of their unused computer equipment and comply with local equipment disposal laws, we are announcing a new computer equipment recycling program. Here’s how it works:

At your request, we will recycle your used computer equipment for you. Computers will have their hard drives rendered inoperable (so that there is no possibility of anyone extracting data from them). We will then transport your equipment to a certified computer equipment recycling center for proper disposal.

To encourage as much participation in this program as possible, we are keeping the fee for this service to a minimum. To have your computers recycled, simply:

- Complete the form below, indicating the quantity of each item to be recycled

- Drop your equipment off at our office (along with this form), or give your equipment to one of our staff persons when they are at your office for another engagement

- We will send you an invoice for the service fee

Vicki Barnes

Director of Payroll Services

Vicki joined Canon Capital in August, 1999 and is responsible for overseeing the daily operations of Payroll Services. Vicki has an Associate’s Degree in Accounting from Montgomery County Community College and has earned the Certified Payroll Professional designation. She is a member of the national American Payroll Association as well the Lehigh Valley Chapter, where she served as Secretary from 2006-2013. Vicki resides in Sassamansville with her husband and son and enjoys crafts, reading, and kayaking in her free time.

Steven L. Moyer Appointed to AICPA Tax Practice Responsibilities Committee

We are proud to announce that Steven L. Moyer, CPA/PFS, CGMA, CSEP, Shareholder and a Director of Canon Capital Management Group’s CPA & Accounting Services division, has been appointed to serve on the American Institute of Certified Public Accountants (AICPA) Tax Practice Responsibilities Committee (TPRC). His 12-month term began May 14, 2025, and will run through May 2026.

This prestigious appointment is a significant professional honor. Steven is one of only five new members selected for this term, joining a group of 15 experts from across the nation. The AICPA chose these individuals for their experience, insight, and dedication to upholding the highest ethical and professional standards in the field of tax services.

About the TPRC

The TPRC plays a critical role in shaping and maintaining the ethical framework that guides AICPA members in their tax practices. Committee responsibilities include:

- Developing and reviewing practice aids to help CPAs maintain the highest level of ethical standards and quality control in tax services

- Monitoring changes in both internal and external ethical standards, such as the AICPA’s Statements on Standards for Tax Services (SSTSs), Treasury Circular 230, and the Internal Revenue Code

- Collaborating with the IRS Office of Professional Responsibility and other key regulatory bodies

- Contributing subject matter expertise on advocacy and practitioner oversight issues

- Working closely with AICPA staff, technical resource panels, and the Tax Executive Committee to support tax practitioners nationwide

Steven’s Commitment to Excellence

Steven L. Moyer brings more than three decades of experience in accounting and tax to the committee. He is known for his strategic thinking, high ethical standards, and leadership in risk management and quality control.

Please join us in congratulating Steven on this well-deserved appointment and honor. His service to the TPRC will not only benefit AICPA members across the country but also continue to strengthen the quality and ethical foundation of the services we provide here at Canon Capital Management Group, benefitting our service to all clients.

Services: Let’s Get Started

Accounting

Our team of certified public accountants, certified management accountants, and chartered global management accountants work with you to understand your goals – personal and business.

Payroll

You didn’t start a business to run a payroll company. We stay up-to-date on the latest tax rates and payroll practices so you don’t have to. Our efficient, cost-effective payroll services allow you to continue working on your business goals.

Wealth Management

- Learn more about wealth management, retirement planning, and 401(k) plan services here

Technologies

We take the worry out of your computer system management. From cyber threat management to data back-up, we work with you to address your concerns and make sure your systems are working for you.

Canon Capital Technical Support Request

The web based support form is no longer in use. Please use the green IT button on your Windows desktop or system tray to submit a support request. If you do not have the green IT button, please give us a call at 215-723-4881, extension 800, and we will be happy to assist you.

Lori E. Benner

Senior Accountant

Lori began working at Canon Capital in September 2022, bringing over 30 years of experience in corporate and partnership tax preparation and financial statement review. Lori earned her BS in Business Administration from Kutztown University and is a member of PSTAP (Pennsylvania Society of Tax and Accounting Professionals). A Perkasie resident, she relaxes by paddleboarding, doing yoga, baking, gardening, and hiking. Lori also enjoys spending time with her son, Collin, and her two mini Goldendoodles, Reilly and Chewie.