If you are working in-house as a bookkeeper or are running your own business, we know that you are already busy with the daily demands of your position. If processing your company’s payroll is among your responsibilities, we are here to bring you relief.

Here is why you should outsource your payroll:

- It saves time.

If your company does not have a dedicated payroll department, chances are it is a task assigned to you in addition to your current work. If you are running your own business, you would probably rather be working on growing your business instead of processing your payroll.

- It saves money.

Outsourcing your payroll saves money in many ways. Taking it off your plate frees you up to do the work you are meant to do. You will also lessen the risk of missing critical deadlines, which could result in penalties.

- It provides convenience and value to you and your employees.

From direct deposit and an online employee portal to tax filing and reporting, the efficiency of outsourcing your payroll provides value to you and your employees.

At this point, you are likely thinking, “That sounds great, but why should I outsource our payroll to you, Canon Capital?”

Why You Should Choose Canon Capital Payroll Services

- Customization

We fully customize your payroll to suit your company’s size and specific needs.

- You don’t know what you don’t know.

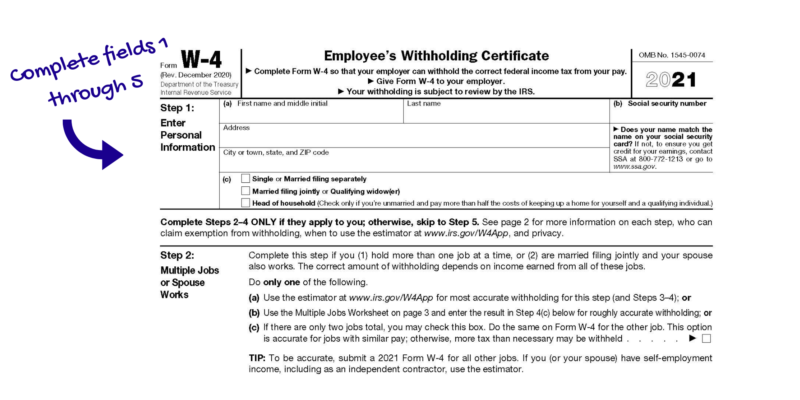

You have your expertise; we have ours. At Canon Capital Payroll Services, it is our responsibility to know about the updates affecting taxes and human resources that impact your payroll.

- Competitive Fees

Our competitive fees keep your payroll costs down while our in-house expertise adds value to the payroll process. Here is what you receive with each processed payroll.

- Responsive Service

We can answer your questions quickly and be responsive to your unique needs, thanks to our payroll professionals and the support of our Certified Public Accounting and Technologies departments.

- Added Value

We provide services that are not always available with other payroll groups, such as withholding and reporting local and LST taxes.

We also offer these optional add-on services:

- 1099 Payments

- 1096 Annual Preparation

- New Hire Reporting

- FICA Tip Credit Report

- Workers Compensation Report

- Labor Distribution Report

- General Ledger Report

- Vacation/Sick Accrual Report

- 401(k) Report

- Check Reconciliation Report

- Certified Payroll Report

- Customized Reports

- Direct Deposit Service

- Vacation/Sick Accrual Tracking

- Job Costing/Labor Allocation

- Check Signature

- Checking Stuffing

- QuickBooks GL Interface

Canon Capital Takes the Hassle Out of Payroll

Conversion to our payroll service is simple and you will find that our comprehensive, easy-to-read reporting is thorough.

In short, outsourcing your payroll to Canon Capital Payroll Services saves you time, money, and stress.

Ready to learn more? Send a note online or call 215-723-4881 so we can begin customizing a payroll plan for your business.