Legislation and developments continue to move at a breathtaking pace with regard to tax filing deadlines and COVID-related legislation. Here at Canon Capital, our workload continues to be full as we prioritize getting our clients the help they need – despite being in the middle of tax season. We’ve gathered the latest updates in this blog post.

Federal Tax Deadline Extended to May 17, 2021 for Some Returns

As you may have heard, the deadline for filing individual tax returns and payments for 2020 has been extended to May 17, 2021. Pennsylvania has adopted the May 17 date as well. However, the April 15 deadline remains for some returns, including C-corporations and trust tax returns. We are still waiting on guidance on gift tax returns. Lastly, and perhaps most oddly, the due date for first quarter estimates for individual returns is still April 15, 2021.

In addition to certain tax return deadlines being extended, the 2020 contribution deadlines for IRAs, Roths, HASs, Archer MSAs, and Coverdell ESAs have also been extended to May 17, 2021.

The AICPA continues to advocate for moving everything normally due on April 15, 2021 to May 17, 2021. Needless to say, we are hoping for some decisions soon.

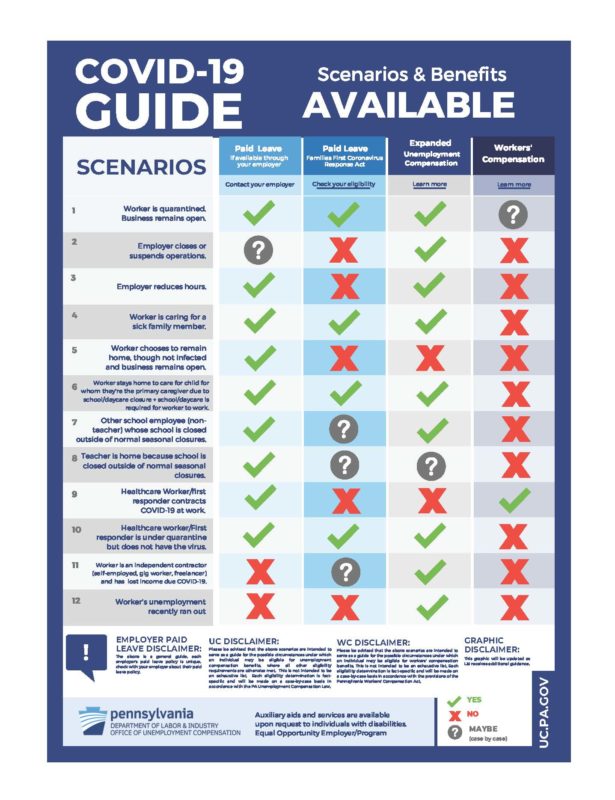

Employee Retention Credit

Many businesses don’t realize they are eligible for these substantial, recently expanded credits. If your business was fully or partially shut down on government order, or you had a “substantial” (either 20% or 50%) decline in gross receipts per quarter compared to 2019, you may be eligible for a credit of up to $7,000 per employee. We have been helping many clients with this credit and its interaction with the PPP loans. Unfortunately, we are hearing too many stories from business owners that their accountant has de-prioritized work related to the ERC. If you are not getting answers and would like to discuss your potential eligibility, please feel free to give us a call.

PPP2 Applications and Draws

As you may have heard, the deadline for applying for a PPP loan has been extended to May 31, 2021. However, in a somewhat unexpected announcement, the SBA announced last week that they are projecting the funds to run out mid-April. Thus, we suggest getting any remaining applications in immediately. There may be a replenishment of funds, but nothing has been announced yet.

Also, at the beginning of March, the SBA changed the formula on how sole proprietors calculate their loans. This change was a huge benefit to schedule C borrowers. There is pressure for Congress to adopt a retroactive law allowing schedule C borrowers funded with applications prior to the change to use the new formula. Again, there is only discussion at this point and nothing imminent. This would also require additional funds to be allocated to the PPP program.

In addition, the SBA has stated that of the approximate 25M schedule C/sole proprietor businesses in the U.S., only 2.6M have applied and been approved for PPP loans. If you have questions about your eligibility, please contact us immediately.

Forgiveness applications should now be available through most or all lenders and should be considered for filing as soon as possible.

Lastly, if you had a “Draw 1” application in January or February (that is your first borrowing under the PPP program), you may now be eligible to submit a “Draw 2” application. Again, if you have questions about eligibility, please contact us immediately.

Economic Injury Disaster Loan Update

The SBA has raised the COVID-19 EIDL loan limit to $500,000. There have also been additional funds made available for the program.

IRS to Recalculate Taxes on Unemployment Benefits

With the American Rescue Plan Act passage in March, there was a retroactive provision that made the first $10,200 of unemployment benefits non-taxable for filers under certain thresholds. The IRS came out with guidance and stated that taxpayers who have already filed their returns should not file an amended return. The IRS will recalculate those returns and issue refunds. The refunds will come in two phases starting in May 2021. The first phase will be for single taxpayers who are eligible for the exclusion. The second phase will include married taxpayers and others with more complex returns. However, the IRS may not calculate returns with additional credits properly, making an amended return necessary after all. Taxpayers need to pay attention to the accuracy of the return.

Other Programs

Other brand-new programs have become available, such as the Shuttered Venue Operators Grant and the Restaurant Revitalization Fund. The funds in these programs will run out fairly quickly, so please make sure you, or your banker or advisor, are ready to apply for these programs when they open.

Affordable Care Premium Tax Credits

The passage of the American Rescue Plan Act also includes a retroactive provision stating a taxpayer does not have to repay any of the advance premium credit for 2020 if they received too much. In this case, taxpayers who already filed their 2020 tax returns will need to file an amended return.

Biden’s Potential Tax Reform

There are currently two bills in Congress that could be part of a Biden tax overhaul. The Sensible Taxation and Equity Promotion (STEP) Act would eliminate stepped-up-basis at death. The bill would allow individuals to exclude up to $1M in unrealized capital gains from tax, as well as provide the opportunity to pay the tax in installments over a 15-year period for capital gains that apply to any illiquid assets like a farm or business. Changes would be retroactive to January 2021. The second, Senator Bernie Sanders’ 99.5 Percent Act, proposes to lower the gift tax exemption to $1M and to limit annual gift tax exemptions.

Needless to say, any Biden tax bill needs to be evaluated seriously. Without Republican support, most likely the earliest any tax plan could pass is late fall or early winter when the reconciliation process becomes available again to Congress. More to come on this over the next few months.

Biden’s $2.3 Trillion Infrastructure, Tax Plus Plan

This topic has just started to be discussed. There may be a possibility for a bill by the end of the summer, so for now, we’ll have to keep our eye on this as well.

Should you have any questions on any of these topics, or any other items that relate to your situation, do not hesitate to contact us at 215-723-4881 or via email. We’ll be happy to discuss your situation with you.

Additional Resources

Recording of February 11, 2021 Seminar: The Expanded Employee Retention Credit

Recording of January 12, 2021 Seminar: Unpacking the Latest COVID-19 Relief Package