With the passage of the Tax Cuts and Jobs Act, you might be receiving a higher net amount of money in your paycheck. To ensure you’re having the right amount of funds withheld in order to avoid a surprise during next year’s tax season, please follow the recommended steps in this message from the IRS:

“The Tax Cuts and Jobs Act made changes to the tax law, including increasing the standard deduction, removing personal exemptions, increasing the child tax credit, limiting or discontinuing certain deductions and changing the tax rates and brackets.

If changes to withholding should be made, the Withholding Calculator gives employees the information they need to fill out a new Form W-4, Employee’s Withholding Allowance Certificate. Employees will submit the completed W-4 to their employer.

The withholding changes do not affect 2017 tax returns due this April. However, having a completed 2017 tax return can help taxpayers work with the Withholding Calculator to determine their proper withholding for 2018 and avoid issues when they file next year.

Steps to Help Taxpayers: Do a ‘Paycheck Checkup’

The IRS encourages employees to use the Withholding Calculator to perform a quick ‘paycheck checkup.’ An employee checking their withholding can help protect against having too little tax withheld and facing an unexpected tax bill or penalty at tax time in 2019. It can also prevent employees from having too much tax withheld; with the average refund topping $2,800, some taxpayers might prefer to have less tax withheld up front and receive more in their paychecks.

The Withholding Calculator can be used by taxpayers who want to update their withholding in response to the new law or who start a new job or have other changes in their personal circumstances in 2018.

As a first step to reflect the tax law changes, the IRS released new withholding tables in January. These tables were designed to produce the correct amount of tax withholding — avoiding under- and over-withholding of tax — for those with simple tax situations. This means that people with simple situations might not need to make any changes. Simple situations include singles and married couples with only one job, who have no dependents, and who have not claimed itemized deductions, adjustments to income or tax credits.

People with more complicated financial situations might need to revise their W-4. With the new tax law changes, it’s especially important for these people to use the Withholding Calculator on IRS.gov to make sure they have the right amount of withholding.

Among the groups who should check their withholding are:

- Two-income families.

- People with two or more jobs at the same time or who only work for part of the year.

- People with children who claim credits such as the Child Tax Credit.

- People who itemized deductions in 2017.

- People with high incomes and more complex tax returns.

Taxpayers with more complex situations might need to use Publication 505, Tax Withholding and Estimated Tax, expected to be available on IRS.gov in early spring, instead of the Withholding Calculator. This includes those who owe self-employment tax, the alternative minimum tax, or tax on unearned income from dependents, and people who have capital gains and dividends.

Plan Ahead: Tips for Using the Withholding Calculator

The Withholding Calculator asks taxpayers to estimate their 2018 income and other items that affect their taxes, including the number of children claimed for the Child Tax Credit, Earned Income Tax Credit and other items.

Take a few minutes and plan ahead to make using the calculator on IRS.gov as easy as possible. Here are some tips:

- Gather your most recent pay stub from work. Check to make sure it reflects the amount of Federal income tax that you have had withheld so far in 2018.

- Have a completed copy of your 2017 (or possibly 2016) tax return handy. Information on that return can help you estimate income and other items for 2018. However, note that the new tax law made significant changes to itemized deductions.

- Keep in mind the Withholding Calculator results are only as accurate as the information entered. If your circumstances change during the year, come back to the calculator to make sure your withholding is still correct.

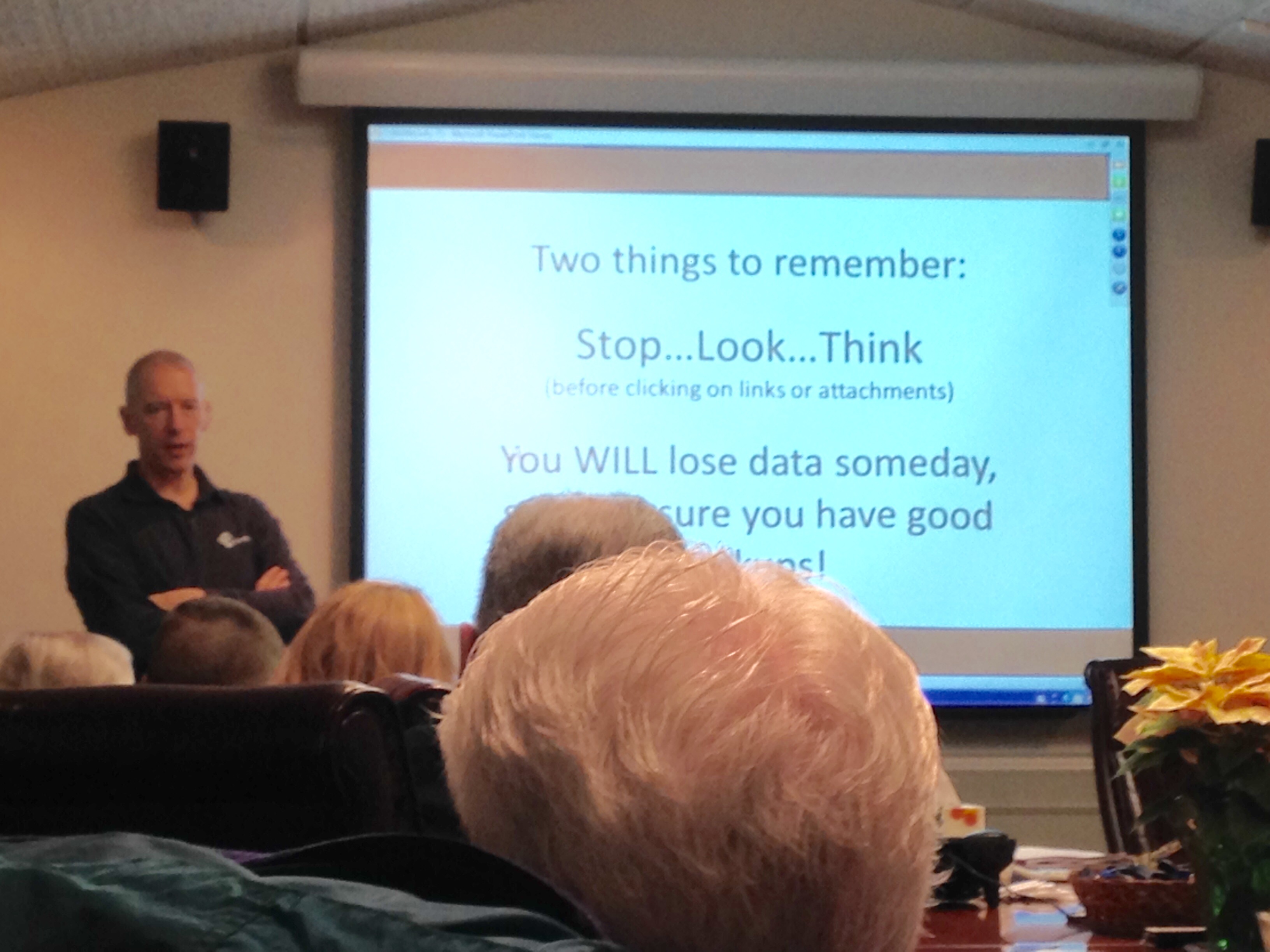

- The Withholding Calculator does not request personally-identifiable information such as name, Social Security number, address or bank account numbers. The IRS does not save or record the information entered on the calculator. As always, watch out for tax scams, especially via email or phone calls and be especially alert to cybercriminals impersonating the IRS. The IRS does not send emails related to the calculator or the information entered.

- Use the results from the Withholding Calculator to determine if you should complete a new Form W-4 and, if so, what information to put on a new Form W-4. There is no need to complete the worksheets that accompany Form W-4 if the calculator is used.

- As a general rule, the fewer withholding allowances you enter on the Form W-4 the higher your tax withholding will be. Entering “0” or “1” on line 5 of the W-4 means more tax will be withheld. Entering a bigger number means less tax withholding, resulting in a smaller tax refund or potentially a tax bill or penalty.

- If you complete a new Form W-4, you should submit it to your employer as soon as possible. With withholding occurring throughout the year, it’s better to take this step early on.”

If you have any questions about your specific situation, please consult with your tax advisor. If you do not currently have a tax advisor, we welcome the opportunity to serve you. Please call 215-723-4881 or contact us online.