Work continues on the new building in Harleysville. We’re looking forward to the New Year, when we anticipate moving in and all four of our business units serving you from under one roof. Stay tuned for continued updates.

Tag: Canon Capital Management Group

New Trustees Reports Show Continuing Financial Challenges for Social Security and Medicare

Every year, the Trustees of the Social Security and Medicare trust funds release reports to Congress on the current financial condition and projected financial outlook of these programs. The 2015 reports, released on July 22, 2015, show that, despite some encouraging signs, both programs continue to face financial challenges that should be addressed as soon as possible, with the Disability Insurance Trust Fund needing the most urgent attention.

What are the Social Security trust funds?

The Social Security program consists of two parts. Retired workers, their families, and survivors of workers receive monthly benefits under the Old-Age and Survivors Insurance (OASI) program; disabled workers and their families receive monthly benefits under the Disability Insurance (DI) program. The combined programs are referred to as OASDI. Each program has a financial account (a trust fund) that holds the Social Security payroll taxes that are collected to pay Social Security benefits. Other income (reimbursements from the General Fund of the Treasury and income tax revenue from benefit taxation) is also deposited in these accounts. Money that is not needed in the current year to pay benefits and administrative costs is invested (by law) in special Treasury bonds that are guaranteed by the U.S. government and earn interest. As a result, the Social Security trust funds have built up reserves that can be used to cover benefit obligations if payroll tax income is insufficient to pay full benefits.

(Note that the Trustees provide certain projections based on the combined OASI and DI (OASDI) trust funds. However, these projections are theoretical, because the trusts are separate, and one program’s taxes and reserves cannot be used to fund the other program.)

Trustees report highlights: Social Security

- The combined trust fund reserves (OASDI) are still increasing and will continue to do so through 2019 (asset reserves increased by $25 billion in 2014, with year-end reserves totalling $2.8 trillion). Not until 2020, when annual program costs are projected to exceed total income, will the U.S. Treasury need to start withdrawing from the reserves to help pay benefits. Absent congressional action, the combined trust fund reserves will be depleted in 2034, one year later than projected in last year’s report.

- Once the combined trust fund reserves are depleted, payroll tax revenue alone should still be sufficient to pay about 79% of scheduled benefits in 2034, with the percentage falling gradually to 73% by 2089. This means that 20 years from now, if no changes are made, beneficiaries could receive a benefit that is about 20% less than expected.

- The OASI Trust Fund, when considered separately, is projected to be depleted in 2035 (one year later than projected in last year’s report). At that time, payroll tax revenue alone would be sufficient to pay 77% of scheduled OASI benefits.

- The DI Trust Fund is in worse shape and will be depleted in late 2016 (the same as projected last year). The Trustees noted that the DI Trust Fund “now faces an urgent threat of reserve depletion, requiring prompt corrective action by lawmakers if suddent reductions or interruptions in benefit payments are to be avoided.” Once the DI Trust Fund is depleted, payroll tax revenue alone would be sufficient to pay just 81% of scheduled benefits.

- Based on the “intermediate” assumptions in this year’s Trustee’s report, the Social Security Administration is projecting that there will be no cost-of-living adjustment (COLA) for calendar year 2016.

What are the Medicare trust funds?

There are two Medicare trust funds. The Hospital Insurance (HI) Trust Fund pays for inpatient and hospital care (Medicare Part A costs). The Supplementary Medical Insurance (SMI) Trust Fund comprises two separate accounts, one covering Medicare Part B (which helps pay for physician and outpatient costs) and one covering Medicare Part D (which helps cover the prescription drug benefit).

Trustees report highlights: Medicare

- Annual costs for the Medicare program have exceeded tax income annually since 2008, and will continue to do so this year and next, before turning positive for four years (2017-2020) and then turning negative again in 2021.

- The HI Trust Fund is projected to be depleted in 2030 (unchanged from last year, but with an improved long-term outlook from last year’s report). Once the HI Trust Fund is depleted, tax and premium income would still cover 86% of program costs under current law. The Centers for Medicare & Medicaid Services (CMS) has noted that, under this year’s projection, the HI Trust Fund will remain solvent 13 years longer than the Trustees predicted in 2009, before passage of the Affordable Care Act.

- Due to increasing costs, a Part B premium increase is likely in 2016. However, about 70% of Medicare beneficiaries will escape the increase because of a so-called “hold harmless” provision in the law that prohibits a premium increase for certain beneficiaries if there is no corresponding cost-of-living increase in Social Security benefits. If there is no COLA for 2016, the increased costs may be passed alng only to the remaining 30% not eligible for this hold-harmless provision – generally, new enrollees, wealthier beneficiaries, and those who choose not to have their premiums deducted from their Social Security benefit. If so, these individuals could see the base premium rise to $159.30 in 2016, up sharply from $104.90 in 2015.

Why are Social Security and Medicare facing financial challenges?

Social Security and Medicare accounted for 42% of federal program expenditures in fiscal year 2014. These programs are funded primarily through the collection of payroll taxes. Partly because of demographics and partly because of economic factors, fewer workers are paying into Social Security and Medicare than in the past, resulting in decreasing income from the payroll tax. The strain on ths trust funds is also worsening as large numbers of baby boomers reach retirement age, Americans live longer, and health-care costs rise.

What is being done to address these challenges?

Both reports urge Congress to address the financial challenges facing these programs in the near future, so that solutions will be less drastic and may be implemented gradually, lessening the impact on the public. As the Social Security Board of Trustees report states, “Social Security’s and Medicare’s projected long-range costs are not sustainable with currently scheduled financing and will require legislative action to avoid disruptive consequences for beneficiaries and taxpayers.”

Some long-term Social Security reform proposals on the table are:

- Raising the current Social Security payroll tax rate (according to this year’s report, an immediate and permanent payroll tax increase of 2.62 percentage points would be necessary to address the revenue shortfall)

- Raising the ceiling on wages currently subject to Social Security payroll taxes ($118,500 in 2015)

- Raising the full retirement age beyond the currently scheduled age of 67 (for anyone born in 1960 or later)

- Reducing future benefits, especially for wealthier beneficiaries

- Changing the benefit formula that is used to calculate benefits

- Changing how the annual cost-of-living adjustment for benefits is calculated

Regardless of the long-term solutions, Congress needs to act quickly to address the DI program’s imminent reserve depletion. According to this year’s report, in the short term, lawmakers may reaollocate the payroll tax rate between OASI and DI (as they did in 1994). However, this may only serve to delay DI and OASI reforms.

You can view a combined summary of the 2015 Social Security and Medicare Trustees reports here, where you can also access a full copy of the Social Security report. You can find the full Medicare report here.

Our Wealth Management team is glad to answer any questions you may have about these reports. Call 215-723-4881 or contact us here.

IMPORTANT DISCLOSURES

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable – we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Prepared by Broadridge Investor Communications Solutions, Inc. Copyright 2015

Happy Thanksgiving

We have much to be thankful for and count you, our clients, among our many blessings. Everyone here at Canon Capital Management Group wishes you and your loved ones a very Happy Thanksgiving.

Why the Big Fuss About Auto Mileage?

If there’s one thing tax preparers can count on after the sun rises each morning, it’s clients wondering why we make such a big deal about having auto mileage, travel and entertainment properly documented.

To answer in detail, everyone is familiar with the principle of “the low hanging fruit” – that is, when we have a very big task to accomplish, we usually go after the easy “low hanging fruit” first. With the well-documented budget cuts to the IRS over the past few years, the IRS is left with limited resources to audit taxpayers. Thus, common sense would tell us they will, and are, concentrating on the “low hanging fruit.” And when it comes to exams of taxpayers, travel and entertainment expenses are the lowest hanging fruit. There are numerous reasons for this.

First, most wage earners receive a W2 at the end of the year reporting their wages. The IRS gets a copy of the W2, so there’s no real subjectivity. Even if the wage earner has interest income, business income reported on a K-1, and mortgage interest deductions – these are all reported to the IRS as well. In contrast, self-employed individuals and businesses self-report practically everything. Therefore, self-employed individuals are generally at a much higher risk of exam. And the expenses that are going to attract additional attention deal with travel and entertainment. The reason these specific expenses draw specific attention are due to their higher substantiation requirements.

There was a fairly famous case, Cohan v. Commissioner, which concluded with the decision that if the taxpayer was unable to substantiate the exact amount of an expense and evidence dictates that an expense was incurred, the proper amount may be estimated by the court.

The IRS and Congress weren’t thrilled at the idea of estimating expenses, so they created a new law concerning auto, travel, meals and entertainment expenses. This law expressly states that no deduction will be allowed as approximations or “unsupported testimony” of the taxpayer. In other words, if you don’t have proper evidence, the IRS will disallow ALL of your expenses – even if evidence indicates that the expenses were incurred.

Keeping Good Records

For travel away from home, the taxpayer must have adequate records to prove the amount, time, the place, and business purpose of the trip. For entertainment, the taxpayer must have adequate records to prove the amount, the time, the place, the business purpose, and the business relationship. For auto mileage, the taxpayer must have adequate records to prove the amount, time, and business purpose of the trip.

In other words, just having receipts for travel away from home and entertainment are not sufficient since the receipt will not document the business purpose or relationship substantiation requirements. And so, you need a contemporaneous (produced in real time) auto log.

There are thousands of cases filled with summary language similar to “Taxpayer didn’t keep or provide contemporaneous written records of time, place, miles driven, or business purpose, and instead conceded that he/she kept poor records…” in which the IRS disallowed ALL of the auto expense claimed – even though evidence indicated an expense was incurred. If that sounds like you – not keeping records in real time – not documenting business reason, place or mileage – or just keeping poor records – your WHOLE deduction is at risk. Even if there is other evidence business mileage was incurred. Again, there are hundreds if not thousands of tax court rulings where the entire auto expense was disallowed even though taxpayers had delivery receipts and other reports to evidence auto mileage had been incurred.

So you can start to see why there is such a big fuss around auto mileage. First, the entire deduction is at risk – not just a portion of it. Thus, when we as tax preparers ask the amount of business mileage incurred, answers like, “Oh, about the same as last year,” are not acceptable. It acknowledges that there are no contemporaneous records that exist to support the deduction. Second – and just as important – under an examination, you want to have the “easy” items correct on your return. Think about it from the examiner’s point of view. If the first thing they look at isn’t correct, how do you think they feel about the rest of the return? Contrast that to having everything documented correctly and making a good first impression. Which situation would you rather have? Everyone would obviously want the latter situation. Thus, keeping contemporaneous records is a big deal.

Here at Canon Capital, we speak from experience. Not too long ago, one of our self-employed clients was examined. The very first item the examiner went after was auto mileage. The examiner spent two full days reconstructing the auto logs from his records, and using other audit techniques. He barely looked at other income or expense items. In the end, our client had contemporaneous records – so the deduction stood, other than a slight miscalculation the client had in calculating the amount of mileage.

So please understand – reporting accurate auto mileage is a big deal. Thus, big deals usually come with a big fuss.

Record-keeping Made Easy

It doesn’t have to be difficult to maintain good mileage records. Stop by our reception area, where we have auto mileage logs available for your use. You might also find mobile apps like TripLog or MileIQ helpful. While the apps provide additional features, by simply tracking the date, mileage, and reason for incurring the mileage each time you travel for business, you will be in good shape.

If you have more questions or would like more advice on maintaining good expense records, we are happy to help. Contact us at 215-723-4881 or www.canoncapital.com.

Canon Capital Supports Generations of Indian Valley’s Reindeer Run

It was a chilly morning but the runners in Generations of Indian Valley‘s Reindeer Run were happy to accept the cups of cool water we provided at the event’s halfway point.

Canon Capital’s Sherri Schaeffer and Lori Canfield are ready to provide refreshments for the runners.

Chuck Porter (pictured in the white shirt), Jen Norman, and Brian Erkes, all from our Wealth Management Unit, participated in the run.

This annual event benefits Generations’ community programs, including Meals on Wheels.

Merry Christmas from Canon Capital Management Group

Our offices will close at Noon on Christmas Eve and will be closed Christmas Day.

We wish you and yours a very Merry Christmas.

Ring in the New, Shred Out the Old: Join Our Cyber Security & Shredding Event January 7, 2016

Ring in the “New” by shredding the “Old.” Join us for a Cyber Security presentation and on-site document shredding event Thursday, January 7, 2016 at our Canon Capital Wealth Management and Family Office Center (2936 Funks Road, Hatfield, PA).

Please join us for refreshments and a presentation on Cyber Security by our industry expert, Kent Gerhart, director of Canon Capital Computer Solutions. Richter’s Shredding will also be on site to safely shred those old, unwanted documents and help you clean out for the New Year.

Presentations will take place at 3:45pm and 5:30pm; please attend as your schedule allows.

Richter’s Shredding will be available 4:15-5:15pm.

In addition, we will be accepting unwrapped donations of any size diapers, wipes, and toys for infants and toddlers to benefit local charities.

RSVPs are appreciated – email Jennifer Norman or call her at 215-723-4881.

Canon Capital Wealth Management: Comments on the Federal Reserve Rate Hike

Based on their belief that the U.S. economy had strengthened, the Federal Reserve on December 16, 2015 made the decision to hike their interest rate from zero to .25 percent. This rate is the interest rate at which a depository institution lends funds maintained at the Federal Reserve to another depository institution overnight. The Federal funds rate is generally only applicable to the most creditworthy institutions when they borrow and lend overnight funds to each other. In spite of being so restricted a market, it has a great effect through the loans of these lending institutions to the rest of the U.S. and even to the Global economy.

While this is a very small increase, it must be remembered that this is the first increase since 2008. This small increase does indicate that future policy tightening, i.e., increasing interest rates, will likely be very measured and will be governed by the future U.S. and global economic outlook.

An Inevitable Increase

The present situation had to change eventually as zero interest rates have crushed conservative savers and continues to reward risk takers which can easily lend to speculative bubbles in asset values. Retirees especially have seen their returns on savings accounts, certificates of deposit, and high quality bonds decline to almost insignificant values. Speculators have been able to borrow at very low rates, via leveraging their funds, to purchase riskier securities and to force their prices to often unrealistic values. This phenomenon of rewarding speculation at the expense of conservative savers is known as Financial Repression.

However, balanced against a relief for savers are the areas of the U.S. and Global economies which will be negatively impacted and are the reason for caution by the Fed. In the U.S. the stronger dollar, as a result of global funds coming to the U.S. for higher return, will make U.S. products more expensive in foreign countries. This can reduce the amount of and profitability of U.S. exports. Furthermore, higher borrowing costs as a result of Fed tightening together with increasing wages, as quality help is becoming scarce, will further impact business returns.

The Global Impact

Internationally, the emerging market countries have already been hit hard by the slowing growth of China (a major market for them) and by the precipitous decline in commodity prices, i.e., iron ore, copper, oil, etc., which many of these countries have as their only major export. Added to this, much of their debt is denominated in U.S. dollars. As the U.S. dollar strengthens as a result of the Fed rate increase, their currencies decline making it harder for them to pay interest and to pay back their debts.

In contrast to the emerging market nations, the more developed economies, i.e., Europe, Japan, and China, central banks are doing the reverse of the U.S. by lowering their rates and printing more money, i.e., quantitative easing. This may make their exports to the U.S. more competitive which will put pressure on the Fed not to further tighten as U.S. manufacturing is still struggling to revive and to be more cost competitive.

Next Steps

Therefore, in view of the above, it would be prudent to not rely too much upon the stated goal of the Fed to raise interest rates incrementally by 1% per year. Even though the U.S. has reached a further stage in the economic cycle than its major developed country peers, further tightening can only be done if the U.S. economy continues to achieve moderate growth.

For the future, professional active managers may be able to derive some benefit from market volatility. However, most investors should primarily stay in high quality companies that can better withstand higher interest rates and expected market volatility. Consumer related sectors, i.e., restaurants, retail, and home improvement should benefit from the stronger dollar and low energy prices. The financial sector will benefit from the increasing interest rates. In view of the present low threat of inflation, quality intermediate term bonds can also be considered.

Roger Small is a Senior Investment Advisor with Canon Capital Wealth Management. A U.S. Navy veteran, Roger earned his MBA from Harvard and is an accredited investment fiduciary.

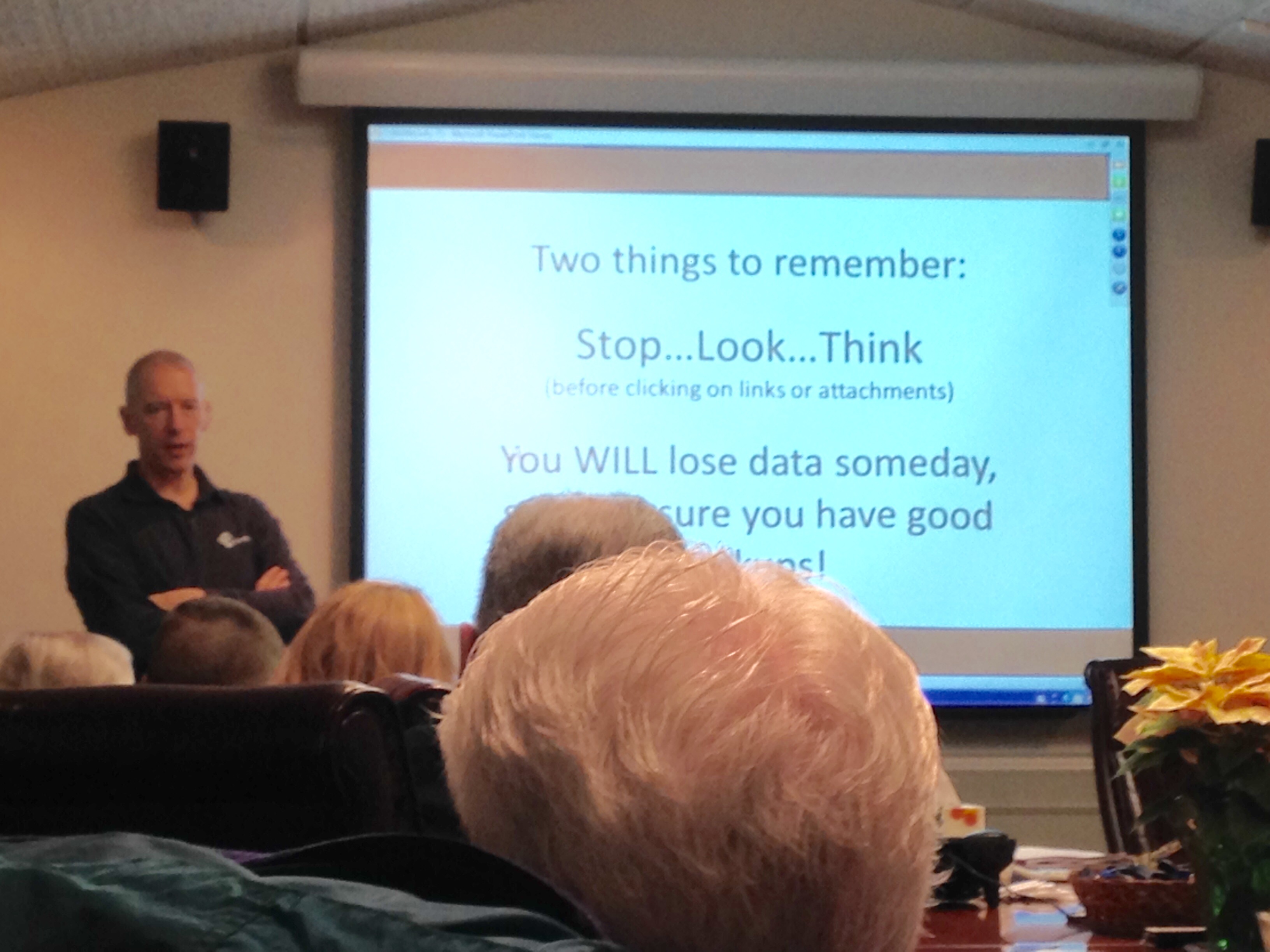

Canon Capital Management Group Kicks Off 2016 with Cyber Security Seminar and Document Shredding Event

With the arrival of the new year, thoughts turn toward clearing out clutter and developing good habits. We were happy to lead the way with our Cyber Security Seminar and Document Shredding event, held Wednesday, January 7 at our Wealth Management & Family Office Services location in Hatfield.

Dr. Peter Roland, Canon Capital Management Group founder and managing director, delivers one of the first containers of documents to be shred.

While Richter’s Mobile Shredding provided the document shredding services, our Computer Solutions owner and director, Kent Gerhart, presented two seminars on the latest news and best practices in cyber security safeguards.

This event was free of charge, with attendees encouraged to bring donations to be distributed to local charities, including diapers, baby wipes and new, unwrapped toys for infants and toddlers. Many thanks to everyone who participated.

Happy New Year from Canon Capital Management Group

Our offices will close at Noon on New Year’s Eve and will be closed New Year’s Day.

We wish you and yours a safe and happy New Year’s celebration.