Archives: Posts

How to Avoid Direct Deposit Fraud

Do you remember the last time you had to visit the bank to deposit your paycheck? For decades, direct deposit has been the efficient and safe way for employees to receive their pay.

This convenience does not come without risk. A new direct deposit scam has recently been making the rounds. We want to make you aware of it and share ways to prevent and avoid direct deposit fraud.

In many cases, the employer receives an email from someone claiming to be an employee. They tell the employer that they have had fraudulent activity on their bank account and need to update their direct deposit information. Without confirming this request directly with the employee, employers have updated the account information. However, the new account information provided belongs to the scammer, not the actual employee. As soon as the scammer receives the funds via direct deposit, they close the account and move on to the next victim.

How can you avoid direct deposit fraud? Here are some best practices:

- Verify employee direct deposit information directly with the employee, whether it is the initial set-up or to make any changes. Confirm these changes with the employee face-to-face. You could also require some sort of documentation, like a voided check or bank statement, to confirm the account belongs to the employee.

- Educate your employees about the risks of direct deposit fraud and how to protect themselves. Encourage them to monitor their accounts regularly and report any suspicious activity immediately.

- If your company is not already doing so, consider using fraud detection software for the corporate bank accounts. This will help detect and prevent direct deposit fraud from happening before it is too late.

You have many opportunities to protect yourself from direct deposit fraud. Consider taking these steps today.

Questions? Call us at 215-723-4881 or contact us online.

Important Dates

Legend

^ National Holiday – Canon Capital/most banks are closed. Allow an extra day for direct deposit services.

+ National Holiday – Most banks are closed. Allow an extra day for direct deposit services.

Calendar Year 2026

^ New Year’s Day – January 1

+ Martin Luther King, Jr. Birthday – January 19

+ President’s Day – February 16

^ Memorial Day – May 25

^ Juneteenth National Independence Day – June 19

^ Independence Day – July 4

^ Labor Day – September 7

+ Columbus Day – October 12

+ Veterans Day – November 11

^ Thanksgiving Day – November 26

^ Christmas Day – December 25

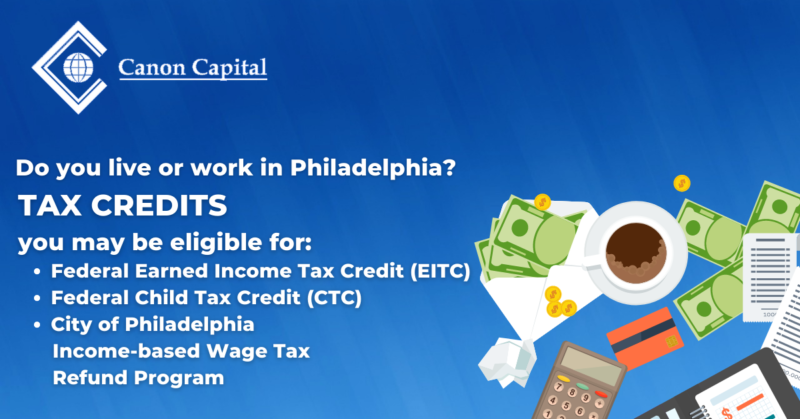

Tax Credits for Employees of Philadelphia-based Businesses and Philadelphia Residents

If you are a Philadelphia resident or work for a business based in Philadelphia, you may be eligible for several tax credits.

- Federal Earned Income Tax Credit (EITC) – potential credit of up to $6,935

- Federal Child Tax Credit (CTC) – potential credit of up to $2,000 per qualifying dependent

- City of Philadelphia Income-based Wage Tax Refund Program

Learn more about these tax credits and how to apply.

Questions? Call us at 215-723-4881 or contact us online.

Quickbooks GL Interface

Our QuickBooks General Ledger interface provides you with online access to your payroll data with every payroll. You instantly save time, reduce errors, and increase flexibility.

Benefits of QuickBooks General Ledger interface include:

- Flexible solution to chart total net pay or each paycheck

- Distribute payroll expenses to multiple accounts and/or departments

- After each payoll, we will instantly generate a file to provide electronic payroll data that you can apply directly to your general ledger.

Payroll Forms & Documents

Do a Paycheck Check-up

The IRS provides an online Withholding Calculator to help you determine the right type of withholding for your situation. But even with this calculator, completing a Form W-4 can be confusing. We’ve provided a step-by-step guide. Follow along with our sample Form W-4 download, available below:

What to Expect in A Tax Audit

As 2023 unfolds, we are already seeing a slight uptick in federal corporate and small business tax return audits. Audits, or exams as they’re known within the accounting world, can come from the federal, state, local, or municipal level. In all instances, the burden of proof lies on the taxpayer.

We recently presented a webinar on the topic, which you can view here:

Highlights of the webinar include:

How Federal Tax Returns Are Selected for An Audit

The IRS uses several elements to determine whether to audit a tax return, including:

- Computer Scoring

- Participants in tax avoidance transactions

- Information Matching

- Related Exams

- Other: local compliance projects, return preparers, market segments

- Random selection

Types of Audits

If your return is selected, it will undergo one of these types of exams:

- No IRS Contact Audits

The tax returns are reviewed based solely on information already available to the IRS. - Correspondence Audits

Generally less intrusive, these exams are typically conducted via mail with minimal phone contact. - Office Audits

The IRS will obtain more information about the taxpayer using agency records and other resources, all prior to the exam, which will focus on “selected areas” of the return. - Field Audits

The most comprehensive of exams, this is performed in the field. Each line of the tax return could be reviewed, and the taxpayer will need to provide substantiation.

What to Expect in a Field Audit

This is the process followed by the IRS for a Field Audit. We recommend involving your tax preparer in this process as their expertise will be key in making sure this process goes smoothly and that you are protected.

- Notification by Mail

- Information Document Requests (IDR): this will usually accompany the notification by mail.

- Taxpayer Site Visit: this will take place at the business or residence – depending upon whether this is an audit of business or personal taxes – to make verifications of certain claims.

- Taxpayer Interview: this is generally a one-to-two-hour process, interviewing the taxpayer and their representative.

- Place of Exam: we recommend this takes place at your tax preparer’s location or at a private, neutral location.

- Proposal to Close

- Appeal, if necessary, based on the IRS agent’s findings.

It is important to know that the IRS will correspond with you by US mail. They will never contact you by phone (not initially; phone calls may happen once an exam process has begun), email, or text message.

We recommend viewing this webinar in its entirety to learn more about ways you can prepare should you ever be selected for a tax audit.

One source, many services, the right decision.

If you have more questions about what to expect in an audit or if we can be of service, please contact us online or call 215-723-4881.

Meet the Newest Members of the Canon Capital Management Group Team

We have recently welcomed these professionals to our team. Some of these faces may be familiar to our clients who are already working with them, but we wanted to make sure we gave Lori, John, Laura, and Daniel a warm welcome.

Lori E. Benner, Senior Accountant

Lori E. Benner is a Senior Accountant with over 30 years of experience in corporate and partnership tax preparation and financial statement review.

John Castro, Technologies Tech Support

John Castro is a graduate of Chestnut Hill College. When he’s not getting our clients’ tech up and running, you can find him surfing and snowboarding.

Laura Eisenschmied, Bookkeeper/Administrative Support

Laura Eisenschmied is a bookkeeper and certified QBO Pro Advisor. In addition to providing bookkeeping services to clients, she is an integral asset to our tax season process.

Daniel Hagen, Staff Accountant

Daniel Hagen is a Staff Accountant who began his accounting career in tax preparation. Currently pursuing his CPA, he is a graduate of Temple University.

Learn more about our Canon Capital Management Group team and how they might be of service to you.

Useful Payroll Links

Find your municipality and tax rate:

munstats.pa.gov/Public/FindMunicipality.aspx

PSD Codes

PSD_CODES_-_2-3-11PUB_3.pdf

American Payroll Association:

americanpayroll.org

IRS – home page:

irs.gov

IRS – forms & publications:

irs.gov/Forms-&-Pubs

Social Security Administration:

ssa.gov

Immigration and Naturalization Service

uscis.gov

Department of Labor:

dol.gov

Pennsylvania Department of Labor & Industry:

dli.state.pa.us

New Jersey Department of Revenue:

state.nj.us/treasury/taxation

Pennsylania Department of Revenue:

revenue.state.pa.us

Berkheimer Associates (Local tax adminstrator):

hab-inc.com

Philadelphia Deparment of Revenue:

phila.gov/revenue/Pages/default.aspx

Department of Community and Economic Development

dced.pa.gov

Keystone Collections Group

keystonecollects.com

Berks Earned Income Tax Bureau

berkseit.com

Andrew Shapowal Earns Personal Financial Specialist (PFS) Credential

Please join us in congratulating Andrew Shapowal, CPA/PFS, AIF® on earning the Personal Financial Specialist (PFS) credential. The PFS credential distinguishes CPAs and enhances their credibility by showcasing their proficiency in personal financial planning. Andrew, who also holds a Certificate in Blockchain and Digital Assets, is an Investment Advisor & Digital Asset Specialist in our Wealth Management business unit.

If you have any current needs regarding digital assets, your investments, or retirement plans, please feel free to contact our Wealth Management department via phone at 215-723-4881 or online.