It’s always a good idea to do a “Paycheck Check-up” at the start of the new tax year or when you experience any change in your income, to make any necessary adjustments to your Form W-4 (Employee’s Withholding Allowance Certificate). Doing so helps to avoid withholding too little Federal tax from each paycheck, which could lead to an unwelcome tax bill or penalties. All that requires is updating the Form W-4 on file with your employer.

The IRS provides an online Withholding Calculator to help you determine the right type of withholding for your situation. But even with this calculator, completing a Form W-4 can be confusing. Let’s break it down:

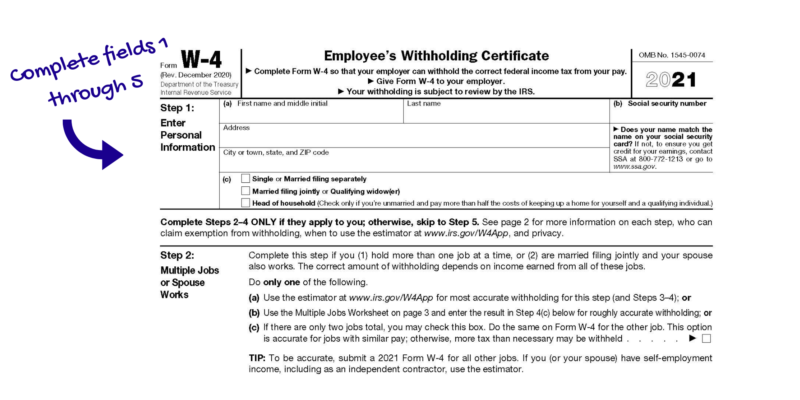

Sections 1 and 5

Sections 1 and 5

These are straightforward, requesting your name, Social Security number, address, marital/filing status, whether or not your name matches your Social Security Card, and your signature.

Sections 2-4

These sections are to be completed only if they apply to your situation, whether you are married, filing jointly, and if your spouse and/or if you hold more than one job at a time. Complete the Two Earners/Multiple Jobs Worksheet on your W-4 to determine these entries.

You may adjust your withholding amounts via an updated Form W-4 as often as necessary for your situation. Outside of changes in your income or tax law, you will also need to complete an updated Form W-4 with these life events:

- Change of address (especially if you move to a new town/township/city/state)

- Change in marital status/marital filing status

- Name change

If you have any questions, we’re here to help. Contact us online or call 215-723-4881.