Work continues on the new building in Harleysville. We’re looking forward to the New Year, when we anticipate moving in and all four of our business units serving you from under one roof. Stay tuned for continued updates.

Archives: Posts

Canon Capital’s Special Guests Greet Reindeer Runners

On Saturday, December 1, 2018, we continued our annual tradition of providing a water station as participants in the Generations of Indian Valley Annual Reindeer Run complete the unforgiving hill of Main Street Souderton. Our own Sarah Hughes (who finished in first place in her category) and Brian Erkes participated alongside the rest of the reindeer antlered, ugly sweater-wearing runners and walkers. We even spotted Batman! However, they couldn’t top our water station volunteers; Canon Capital’s Mike Witter was joined by The Grinch and the big man himself, Santa Claus. The Reindeer Run benefits the programs of Generations of Indian Valley, including their Meals on Wheels service.

View the complete photo gallery on our Canon Capital Facebook page and the Generations of Indian Valley Facebook page.

Canon Capital Staff News – Congratulations to Bradley Barnhorst, CPA, CFA

Congratulations to Bradley Barnhost on earning his Certified Public Accountant (CPA) designation. Brad joined Canon Capital in 2016 and serves as Investment Committee Counsel to our Wealth Management division. He is a recognized expert in investment portfolio risk and volatility reduction, with numerous published works in both scholarly and professional journals. He also holds the Chartered Financial Analyst (CFA) designation. In addition to his role here at Canon Capital, he serves as the Chair of the Finance Major program for both the undergraduate and graduate divisions at DeSales University. He has prior experience as an Associate Director for Bear, Stearns & Co. specializing in structured equity products and derivatives geared to mitigating investment risk. He has earned a Bachelor of Arts Degree in Computer Science from Harvard University as well as a Master of Business Administration (MBA) with a concentration in Corporate Finance and Investment Management from Penn State University.

UPDATE to Can I Deduct That? News on Changes to Meals and Entertainment Expenses

We recently shared the changes brought to Meals and Entertainment expense deductions as a result of the Tax Cuts and Jobs Act. Since first sharing that information, the IRS has issued additional guidance on these deductions.

Under this interim guidance, issued October 3, 2018, meals for entertaining clients, prospects, and the like remain 50% deductible, meaning taxpayers may deduct 50% of an otherwise allowable business meal expense if:

- The expense is ordinary and necessary.

- The expense is not lavish or extravagant.

- The taxpayer or taxpayer’s employee(s) is/are present at the meal.

- Food and beverage are purchased separately from any entertainment, or the food and beverage cost is separately stated on the invoice.

Taxpayers may rely on this guidance pending the issuance of proposed regulations by the IRS.

If you have questions or would like to set up a tax planning session, contact us online or call 215-723-4881.

Should You Choose a Different Business Structure After the Tax Cuts and Jobs Act?

The Tax Cuts and Jobs Act was passed by Congress in November of 2017 but did not take effect until the beginning of this tax year (2018). It brings enough significant change to the tax code to prompt the question, “Should I choose a different structure for my business to take full advantage of this new law?” Our answer: “Yes, No, Maybe.”

Fortunately, those are the only three choices. Unfortunately, these otherwise simple choices become more complicated when associated with the tax code. As you can probably imagine, one size does not fit all when it comes to tax planning. It never did. And, with the Tax Cuts and Jobs Act, one size doesn’t even fit one size anymore.

For instance, if you’re a business owner whose company is structured in any way other than a C-corporation, you might be aware of the new “Qualified Business Income Deduction.” With the Qualified Business Income Deduction, you get to deduct 20% of your flow-through business income on your personal tax return and pay tax on 80% of the business income. Sounds simple, right? This section of tax law has more restrictions and limitations – we’ll call them “weeds” – than Round-Up could ever hope to control, but we’ll keep the explanation that simple to gain a general understanding.

If your business is a Sole Proprietorship with no payroll and no assets that nets $200,000 – absent of any “weeds” – you get a whopping $40,000 deduction and pay tax on only $160,000 of your net income. Since a sole proprietorship does not differentiate between the business and the owner, the owner is entitled to take the full $200,000 “out of the business” without any tax consequences.

Ah, but now here comes a “weed.” Corporations are required to pay salaries to the owner for the money they take out of the business. Partnerships must classify the money the owner takes out for services as “guaranteed payments.” Both salaries and guaranteed payments do not qualify for the 20% deduction mentioned above.

Therefore, if the Corporation or Partnership has the same $200,000 net annual income, and they pay a salary (Corporation) or guaranteed payment (Partnership) of $80,000, then what remains eligible for the 20% deduction is the $120,000 bottom line business income. So, a business organized as a Corporation or Partnership, doing the same exchange for services as a Sole Proprietorship, netting the same annual income, will only qualify for a $24,000 deduction. The only difference between the three? Their business entity structure. And so, one size – each one is a business — isn’t truly one size under the Tax Cuts and Jobs Act.

By now you’re probably thinking, the best recommendation would be to structure your business as a Sole Proprietor if your business type allows for that to make sense. Yes, but, what happens when the business is even more profitable than $200,000 per year? Let’s say that in 2019, you net $500,000 (before salaries or guaranteed payments). That’s when the “weeds” really take over, and their explanation would require a dissertation, not a blog post. Take our word for it. With such an increase in income, under the Tax Cuts and Jobs Act, the Sole Proprietor, and Partnership businesses would not qualify for any deduction. And yet, an S-Corporation that is the same business, providing the same services, netting the same income, would qualify for a $62,500 deduction.

So, not only is “one size fits all” a thing of the past. “One size” isn’t even “one size” from year to year. What happens when your Sole Proprietorship profit is low one year and high the next? You can’t switch business entities each year based on projected income. So, based on the current realities of the tax code, what is the wisest move for a business owner? Absent any other information, the recommendation would be to do business as an S-Corp.

This new tax code will affect every business in the United States, regardless of size or entity structure, which is how we arrived at our initial answer to the question, “Should I change my business structure under the Tax Cuts and Jobs Act?” is “Yes. No. Maybe.”

Let’s find out what entity will be right for you. Contact us online or call 215-723-4881 to schedule a consultation.

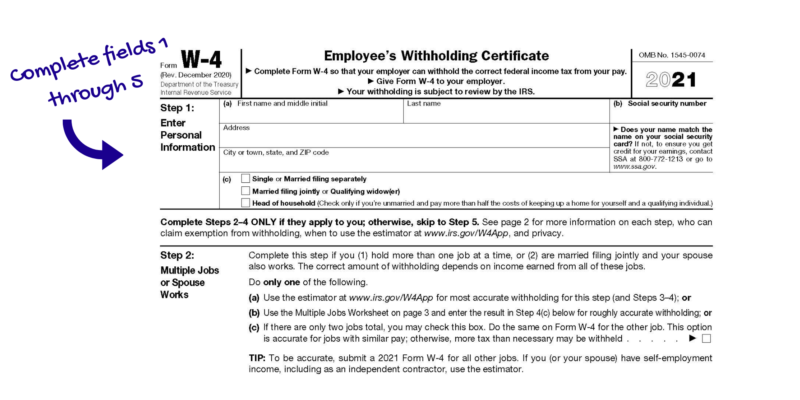

How to Complete a Form W-4: Updated for 2021

It’s always a good idea to do a “Paycheck Check-up” at the start of the new tax year or when you experience any change in your income, to make any necessary adjustments to your Form W-4 (Employee’s Withholding Allowance Certificate). Doing so helps to avoid withholding too little Federal tax from each paycheck, which could lead to an unwelcome tax bill or penalties. All that requires is updating the Form W-4 on file with your employer.

The IRS provides an online Withholding Calculator to help you determine the right type of withholding for your situation. But even with this calculator, completing a Form W-4 can be confusing. Let’s break it down:

Sections 1 and 5

Sections 1 and 5

These are straightforward, requesting your name, Social Security number, address, marital/filing status, whether or not your name matches your Social Security Card, and your signature.

Sections 2-4

These sections are to be completed only if they apply to your situation, whether you are married, filing jointly, and if your spouse and/or if you hold more than one job at a time. Complete the Two Earners/Multiple Jobs Worksheet on your W-4 to determine these entries.

You may adjust your withholding amounts via an updated Form W-4 as often as necessary for your situation. Outside of changes in your income or tax law, you will also need to complete an updated Form W-4 with these life events:

- Change of address (especially if you move to a new town/township/city/state)

- Change in marital status/marital filing status

- Name change

If you have any questions, we’re here to help. Contact us online or call 215-723-4881.

Philadelphia Wage Tax Changes July 1, 2018

July 1, 2018 marks the beginning of the new fiscal year for the City of Philadelphia and with it a reduction in the Wage Tax.

The Wage Tax affects all businesses that operate within the city as well as businesses outside of the city who hire Philadelphia residents.

Any paycheck issued with a pay date after June 30, 2018 must withhold the Philadelphia City Wage Tax at these new rates:

- 3.8809% (.038809) for Philadelphia residents

- 3.4567% (.034567) for non-residents

If you are a Philadelphia-based business who does not collect the Wage Tax on behalf of your employees, or if you work for a business in Philadelphia and do not have the Wage Tax collected on your behalf, you – the employee – are responsible to pay an Earnings Tax directly to the City of Philadelphia. These rates will also be lower as of July 1, 2018:

- 3.8809% (.038809) for Philadelphia residents

- 3.4567% (.034567) for non-residents

We are happy to answer any questions you might have regarding this or any issue related to your payroll. Call 215-723-4881 or contact us online.

Team Canon Capital Participates in the Indian Creek Foundation 2018 Roll, Stroll & Run

On Saturday, June 16, 2018, Team Canon Capital joined the many participants in Indian Creek Foundation’s annual Roll, Stroll & Run, an event including opportunities to raise funds by running, walking, or cycling.

Canon Capital Payroll processer/tax preparer Linda Covel brought some family members along for the 5K walk while Canon Capital Wealth Management project coordinator, Brian Erkes, his wife, Janice, and son, Frank, ran in the timed 5K portion of the event, where they placed within the top 15 participants.

In addition to sending a team, we served as the event’s Volunteer Shirt Sponsor.

We are proud to support the efforts of Indian Creek Foundation, whose mission is “to provide opportunities for people with intellectual and developmental disabilities to live in and enrich the community throughout their lives.”

We’ll Soon be One Source, Many Services, the Right Decision — All Under One Roof at our New Harleysville Location

We are excited to inform you that later this year, we are looking forward to moving from our Souderton and Hatfield offices to combine under one roof at our newly-acquired Harleysville location.

We’ll keep you posted on our progress with the building renovations as we work to make it our own before settling in. Until then, we are happy to continue to serve you at our Souderton and Hatfield locations.

One Source. Many Services. The Right Decision. This is our motto, which we strive to embody each and every day as our four business units work to serve your Accounting, Computer Solutions, Payroll, and Wealth Management needs.

Personal Wealth Opportunities Under the New Tax Laws: A Canon Capital Wealth Management Financial Literacy Seminar

Many are wondering how the new tax laws will affect them in the short and long-term. Our Wealth Management unit dedicated the first Financial Literacy seminar of the year to the topic, with our managing director of Wealth Management, Dr. Peter Roland, providing an overview of what to expect and how best to prepare.

In addition to the overview we’ll present in this blog post, you may view the full webinar here. You may download the presentation to follow along, take notes, and note any questions.

The official name for the bill that passed in December 2017 is “An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018.” Not very catchy, Congress has dubbed it the “Tax Cuts and Jobs Act.” No matter the name, what this bill was designed to do is lower general tax rates, while also making changes to the deductions and exemptions many have grown accustomed to. With that, this bill creates “winners,” “losers,” and considerations and opportunities for both short and long-term wealth management.

Changes in Tax Rates and Deductions/Exemptions

With this new plan, individual tax rates have dropped, meaning many are seeing more money in their paychecks. At the same time, the standard deduction amounts have nearly doubled. However, this can lead to an issue at tax time for taxpayers with large itemized deductions and personal exemptions. Their tax liability may go up even though the rate at which they are being taxed is lower. To make sure you’re not headed for a surprise when your 2018 taxes are being prepared, do what we call a “Paycheck Check-up”. Use the withholding calculator provided by the IRS to make sure enough money is being withheld from your pay.

With this new plan, individual tax rates have dropped, meaning many are seeing more money in their paychecks. At the same time, the standard deduction amounts have nearly doubled. However, this can lead to an issue at tax time for taxpayers with large itemized deductions and personal exemptions. Their tax liability may go up even though the rate at which they are being taxed is lower. To make sure you’re not headed for a surprise when your 2018 taxes are being prepared, do what we call a “Paycheck Check-up”. Use the withholding calculator provided by the IRS to make sure enough money is being withheld from your pay.

Among the changes in itemized deductions in the Tax Cuts and Jobs Act:

- Medical expenses for 2018 and 2019 are now deductible in excess of 7.5% of adjusted gross income (AGI). Before it was in excess of 10% of your AGI.

- Deduction for State, Local, and Real Estate taxes (SALT) is limited to $10,000.

- Deduction for Mortgage Interest Qualified Acquisition Debt reduced from $1,000,000 to $750,000 for first or one second home.

- Home Equity Loans other than the amount used to acquire or improve the home are no longer deductible.

- Charitable contributions can now offset 60% of AGI (was 50%).

- Casualty losses eliminated except for federally-declared disaster areas.

- Miscellaneous Itemized Deductions eliminated (unreimbursed employee business expenses, investment fees, tax prep fees).

- Personal Exemptions have been eliminated (was $4,050 per Exemption in 2017).

- Higher exemptions for Alternative Minimum Tax.

- Alimony is not taxable by recipient (or deductible by payor) for new agreements after 12/31/2018.

- Homeowners gain exclusion ($250,000/$500,000) now requires that the homeowner must live in the residence five of the prior eight years as opposed to two of the prior five years.

This new law has also affected credits and deductions related to child care and college savings:

- Child Care Credit increased from $1,000 to $2,000.

- Section 529 Education Plans allowed to distribute up to $10,000 for elementary, secondary, and certain home school expenses.

- Investment income of child now taxed at higher trust tax rates vs. individual tax rates.

Estate & Gift Taxation as changed as follows:

- Federal exemption of estate tax is now $11.2 million per person (to be adjusted for inflation).

- Higher Annual Gift Tax exemption amount of $15,000 (raised from $14,000).

Business owners will see a reduction in tax rates as well:

- Regular “C” Corporation: highest tax rate reduced from 35% to 21%

- Higher Section 179 depreciation deduction limits

- New deductions for 20% of qualified business net income from passthrough entities (S Corporations, Partnerships, LLC’s, Sole Proprietorships).

- Income limits for 20% benefit – $157,500 and $315,000 taxpayer income.

- 20% deduction of income from REIT dividends, Master Limited Partnership dividends, and Co-ops.

- Real Estate now counts as a qualified business.

Truc Alert

A “Truc” is not some advanced financial term. It’s the word our local Pennsylvania Dutch use for “trick.” Under this new tax law, even though for many the tax rate will go down, the amount of tax owed will increase. In addition:

A “Truc” is not some advanced financial term. It’s the word our local Pennsylvania Dutch use for “trick.” Under this new tax law, even though for many the tax rate will go down, the amount of tax owed will increase. In addition:

- These reduced tax rates and standard deduction changes for individuals will sunset, aka disappear, in 2025.

- Those beneficial provisions will be disappearing on a now-expanded income base.

- The new IRS inflation factor calculation for brackets modified are now using “Chained CPI,” resulting in higher taxes over time as a result of “taxflation.”

Strategies

How can you make the best of the advantages and disadvantages of this new tax law? In addition to the “Paycheck Check-up” we recommended earlier, you might also consider:

How can you make the best of the advantages and disadvantages of this new tax law? In addition to the “Paycheck Check-up” we recommended earlier, you might also consider:

- Take advantage of “Tax Arbitrage” when possible.

- Use donor-advised funds to “bunch” charitable contributions, using appreciated assets when possible.

- Look at your “bucket list,” the funds you choose to be taxed now, taxed later, and never taxed (i.e., Roth IRA).

- Review Roth IRA opportunities

- Consider real estate investments to enjoy the 20% deduction of net income from investment real estate activity. This is especially key as many will opt to rent over buying a home with the loss of the itemized deduction benefit.

- Evaluate your personal debt and consider paying off non-deductible home equity loans more quickly that are no longer subject to interest deductibility.

- Plan for and use the 20% deduction against “Qualified Business Income” and evaluate your business structure for new rules.

- Make optimal use of “portability” election in estates to maximize the exemption available to surviving spouse, not forgetting about step up in tax basis for assets flowing through estates. Also consider State inheritance taxes in your planning.

We’ve included a lot of information in this blog post. Take about 45 minutes of your time, watch the webinar, and please let us know if we can help with any questions you might have regarding this or any other financial services matter. Contact us online or call 215-723-4881.