In an effort to support our environment, provide our customers with a cost-effective, easy way to dispose of their unused computer equipment and comply with local equipment disposal laws, we are announcing a new computer equipment recycling program. Here’s how it works:

At your request, we will recycle your used computer equipment for you. Computers will have their hard drives rendered inoperable (so that there is no possibility of anyone extracting data from them). We will then transport your equipment to a certified computer equipment recycling center for proper disposal.

To encourage as much participation in this program as possible, we are keeping the fee for this service to a minimum. To have your computers recycled, simply:

- Complete the form below, indicating the quantity of each item to be recycled

- Drop your equipment off at our office (along with this form), or give your equipment to one of our staff persons when they are at your office for another engagement

- We will send you an invoice for the service fee

Computer Equipment Recycling Program (PDF)

The web based support form is no longer in use. Please use the green IT button on your Windows desktop or system tray to submit a support request. If you do not have the green IT button, please give us a call at 215-723-4881, extension 800, and we will be happy to assist you.

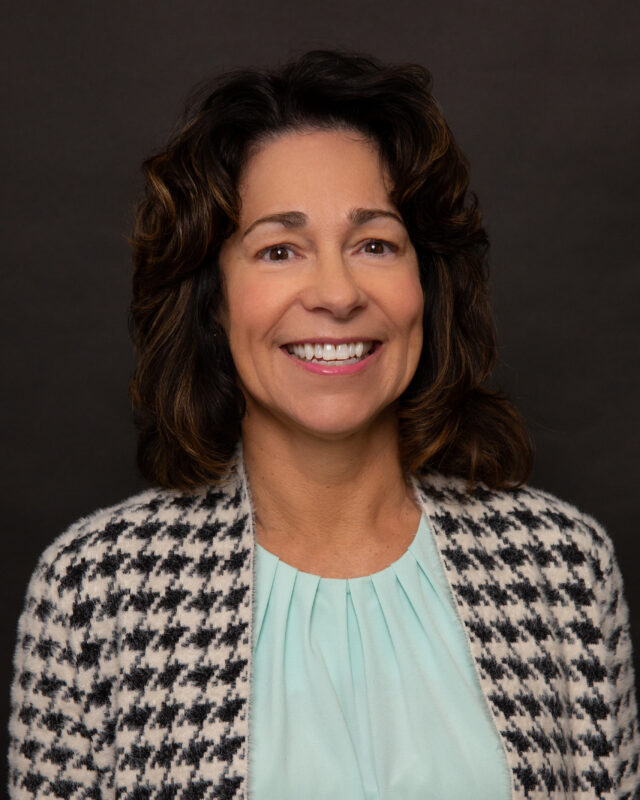

Senior Accountant

Lori began working at Canon Capital in September 2022, bringing over 30 years of experience in corporate and partnership tax preparation and financial statement review. Lori earned her BS in Business Administration from Kutztown University and is a member of PSTAP (Pennsylvania Society of Tax and Accounting Professionals). A Perkasie resident, she relaxes by paddleboarding, doing yoga, baking, gardening, and hiking. Lori also enjoys spending time with her son, Collin, and her two mini Goldendoodles, Reilly and Chewie.

What does the future hold for global equities? Here are five reasons they may defy the odds.

If you have questions about this information or would like to discuss your portfolio, we are happy to help. Call us at 215-723-4881.

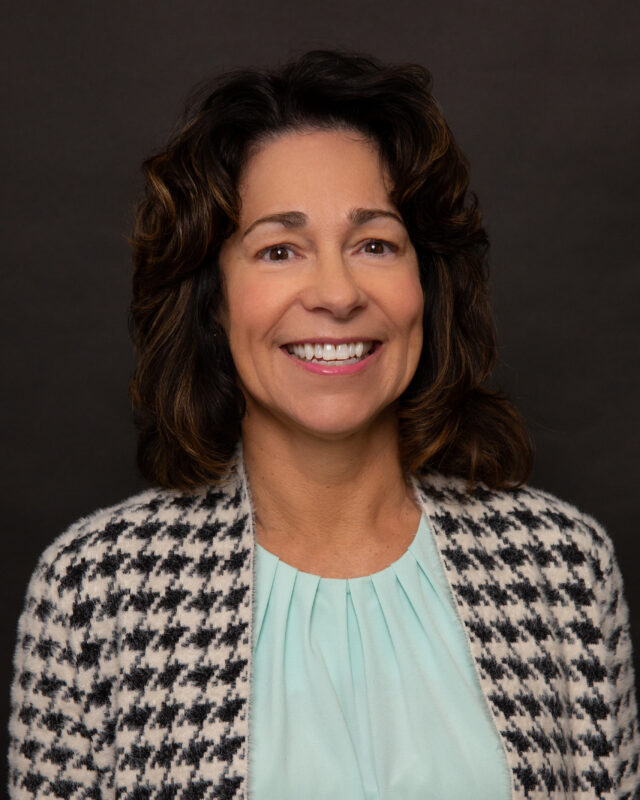

Administrative Assistant

Becky joined Canon Capital in 2002. Prior to Canon Capital, she worked for an auto dealership and computer software company. She attended Montgomery County Community College for business. She resides in Tylersport with her husband and they have three children and nine grandchildren. Becky is active in her church and enjoys making crafts and baking. She also loves to take her vacations in Duck, North Carolina.

The web based support form is no longer in use. Please use the green IT button on your Windows desktop or system tray to submit a support request. If you do not have the green IT button, please give us a call at 215-723-4881, extension 800, and we will be happy to assist you.

Accounting

Our team of certified public accountants, certified management accountants, and chartered global management accountants work with you to understand your goals – personal and business.

Payroll

You didn’t start a business to run a payroll company. We stay up-to-date on the latest tax rates and payroll practices so you don’t have to. Our efficient, cost-effective payroll services allow you to continue working on your business goals.

Wealth Management

We work with business owners and personal investors to provide unbiased advice and clear expectations on investment choices. We work with companies to develop successful retirement plans, such as 401(k) and 403(b) plans, helping employees reach their retirement goals.

Technologies

We take the worry out of your computer system management. From cyber threat management to data back-up, we work with you to address your concerns and make sure your systems are working for you.

The web based support form is no longer in use. Please use the green IT button on your Windows desktop or system tray to submit a support request. If you do not have the green IT button, please give us a call at 215-723-4881, extension 800, and we will be happy to assist you.

Investment Committee Counsel

Brad joined Canon Capital in 2016 and serves as Investment Committee Counsel. He is a recognized expert in investment portfolio risk and volatility reduction, with numerous published works in both scholarly and professional journals. In addition to his role with Canon Capital, he serves as the Chair of the Finance Major and CFP Program Director for both the undergraduate and graduate divisions at DeSales University. He has prior experience as an Associate Director for Bear, Stearns & Co. specializing in structured equity products and derivatives geared to mitigating investment risk. He holds the Chartered Financial Analyst (CFA) designation. He has earned a Bachelor of Arts Degree in Computer Science from Harvard University as well as a Master of Business Administration (MBA) with a concentration in Corporate Finance and Investment Management from Penn State University.