Every 66 seconds another American is diagnosed with Alzheimer’s Disease or another form of dementia. Currently the sixth leading killer in the United States, it is estimated that 5.4 million Americans suffer from this debilitating condition, a number that is expected to grow to 7.1 million by 2025.

You might be asking yourself, “What does this have to do with financial planning?” While there is no cure for Alzheimer’s disease, there are benefits to early diagnosis. This additional time allows the person affected and his/her family to get a jump start on treating the symptoms of the disease as well as plan for the care that will be needed, emotionally and financially.

It is in that spirit that we kicked off our 2017 series of Financial Literacy seminars on Thursday, March 30 with The Alzheimer’s Tsunami: Preparing for the Worst, presented by Jack Broyles. Mr. Broyles, a veteran of the financial services industry, experienced the effects of Alzheimer’s disease firsthand when it took the life of his mother in 2004. He now serves as chairman emeritus of the Dallas Chapter of the Alzheimer’s Association, traveling the United States sharing his experience to help others cope and learn how to navigate this new normal.

The first step is to get the diagnosis. Noting that it’s often the person’s family who can best track the symptoms, Mr. Broyles advised to be aware if your loved one starts showing the initial “mild” signs of dementia, such as trouble handling money, wandering and getting lost, repeating questions, losing things in odd locations, taking longer to complete daily tasks, or showing changes in behavior or personality.

The first step is to get the diagnosis. Noting that it’s often the person’s family who can best track the symptoms, Mr. Broyles advised to be aware if your loved one starts showing the initial “mild” signs of dementia, such as trouble handling money, wandering and getting lost, repeating questions, losing things in odd locations, taking longer to complete daily tasks, or showing changes in behavior or personality.

Believing that informed clients make informed decisions, Mr. Broyles added that following a diagnosis you should contact the local chapter of the Alzheimer’s Association and arrange a meeting with your financial advisor. Start planning on the type of care you want for your loved one, who will provide it, and how you will pay for it.

Elaine Griffin, the manager of corporate and volunteer engagement with the Delaware Valley Chapter of the Alzheimer’s Association, was also in attendance for our seminar. She advised that the Alzheimer’s Association exists to support the person living with the disease and their caregivers. Equipped with knowledge, support groups, and a 24/7 Helpline, the Alzheimer’s Association is a vital resource.

Mr. Broyles also offered these tips for caregivers to help their loved ones live with dementia:

• Make sure they feel safe and loved.

• Be positive.

• Focus on what the person can do, not what they can’t do.

• Combine their medication regimen with stimulation, activity like music or movies. This helps trigger memories.

• Create a collection of life stories – everything that makes them who they are – in writing or even via audio or video recording. This creates their legacy.

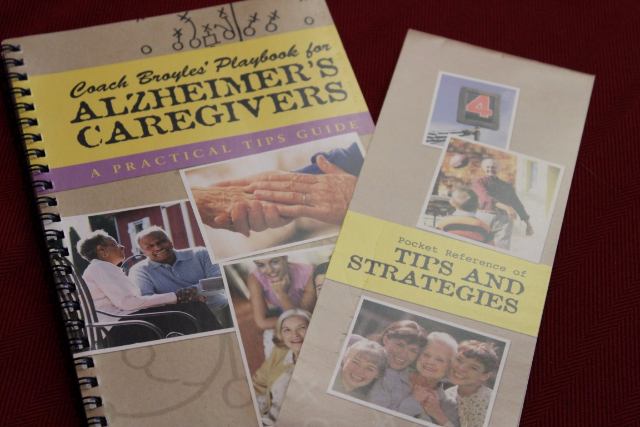

Jack Broyles’ father, Frank Broyles – whom some of you might know from his time as head football coach at the University of Arkansas – has written a book, Coach Broyles’ Playbook for Alzheimer’s Caregivers, full of practical advice. To purchase a copy, visit www.broylesfoundation.com/playbook/.

To learn more about the services of the Alzheimer’s Association, visit alz.org/delval.

To learn more about the services of the Alzheimer’s Association, visit alz.org/delval.

L-R: Phil Keeler; Chuck Porter; Patty Webb; Brian Erkes; Jack Broyles; Fred Fifield, American Beacon; Elaine Griffin; Joan Buschman; Roger Small

We are also glad to be of service, helping you make wise decisions now, so you have peace of mind in the future. Learn more about our Wealth Management services or call 215-723-4881.